As we move into the second half of 2024, Social Security beneficiaries are keenly anticipating their July payments. These payments are crucial for millions of Americans who rely on Social Security for financial stability. This guide provides comprehensive details about the Social Security payments for July 2024, including the payment schedule, recent changes, and tips for managing your benefits effectively.

Payment Schedule for July 2024

Regular Payment Dates

Social Security payments are typically distributed based on the birth date of the beneficiary. Here’s the payment schedule for July 2024:

- July 10, 2024: Payment for beneficiaries born on the 1st to the 10th of the month.

- July 17, 2024: Payment for beneficiaries born on the 11th to the 20th of the month.

- July 24, 2024: Payment for beneficiaries born on the 21st to the 31st of the month.

Exceptions and Special Payments

- Supplemental Security Income (SSI): SSI payments are usually distributed on the 1st of the month. For July 2024, SSI beneficiaries will receive their payments on July 1st.

- Federal Holidays: If a payment date falls on a federal holiday, the payment is typically made on the preceding business day. However, there are no federal holidays in July 2024 that affect the payment dates.

Recent Changes to Social Security Payments

Cost-of-Living Adjustment (COLA)

In January 2024, Social Security benefits saw a significant increase due to the annual Cost-of-Living Adjustment (COLA). This adjustment is based on inflation and is intended to help beneficiaries maintain their purchasing power. For 2024, the COLA was 3.2%, resulting in higher monthly payments for beneficiaries.

Medicare Premiums

Medicare Part B premiums can affect the net amount of Social Security benefits received. In 2024, the standard monthly premium for Medicare Part B increased slightly. Beneficiaries should review their benefit statements to understand the impact of Medicare premiums on their net Social Security payments.

Understanding Your Social Security Benefit Statement

Accessing Your Statement

Beneficiaries can access their Social Security benefit statements online through the Social Security Administration (SSA) website. The statement provides detailed information about your monthly benefit amount, including any deductions for Medicare premiums.

Reviewing Your Payment Amount

Your benefit statement will show:

- Gross Benefit Amount: The total monthly benefit before any deductions.

- Deductions: This includes Medicare premiums and any voluntary tax withholdings.

- Net Benefit Amount: The amount deposited into your bank account.

Tips for Managing Your Social Security Benefits

Budgeting and Financial Planning

To make the most of your Social Security benefits, consider these financial tips:

- Create a Budget: Outline your monthly income and expenses to manage your finances effectively.

- Prioritize Essential Expenses: Ensure that your essential needs, such as housing, food, and healthcare, are covered first.

- Save for Emergencies: Set aside a portion of your benefits each month to build an emergency fund.

Maximizing Benefits

- Review Your Benefit Statement Regularly: Check your statement each month to ensure accuracy and stay informed about any changes.

- Consider Delaying Benefits: If possible, delaying your retirement benefits until after your full retirement age can result in higher monthly payments.

- Explore Additional Assistance Programs: Look into other federal and state programs that can provide additional financial support, such as Supplemental Nutrition Assistance Program (SNAP) or Medicaid.

Addressing Common Concerns

Payment Delays

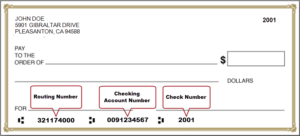

If you experience a delay in receiving your payment, contact the SSA immediately. Ensure your direct deposit information is accurate and up-to-date to avoid delays.

Reporting Changes

Beneficiaries must report any changes in their circumstances that could affect their benefits, such as changes in income, address, or marital status. Reporting these changes promptly can prevent overpayments and ensure you receive the correct benefit amount.

Conclusion

Social Security payments are a lifeline for millions of Americans, providing essential financial support. Understanding the payment schedule, recent changes, and tips for managing your benefits can help you make the most of your Social Security income. Stay informed and proactive about your benefits to ensure financial stability and peace of mind. For more detailed information, visit the official Social Security Administration website or contact a financial advisor.